• Residential properties are assessed at market value, as of July 1st of the year prior to the tax year. Market value is estimated by analyzing the sales of all property types throughout the Municipality. Mass appraisal techniques are used in this valuation process. The Alberta Provincial Government legislation states that the assessment ratio, for all residential properties be 95 to 105 per cent.

• As required under the Alberta Municipal Government Act, assessors collect and update information regarding property to ensure fair and accurate assessments. Assessors conduct site inspections periodically to update property assessments. Inspections start early in the year and run until the end of each year. Inspections may include measuring buildings, photographing exteriors, and gathering details regarding interior components and use of the property. Inspections for your property may occur if there has been a recent building permit issued or a physical change, if your property has recently been purchased or sold, or if your property is in the annual re-inspection area.

• Non-Residential category of property refers to property where retail, office, industrial, or other non residential activities occur. Properties that have a multi-purpose use, such as a commercial business operating from a residential acreage, will have the commercial portion of the assessment classed as non-residential. Non-residential land, buildings and structures are assessed at market value as of July 1 of the year proceeding the tax year.

• Farmland is assessed on the ability of land to produce agricultural products. The Minister’s Guidelines in conjunction with the Alberta Farmland Assessment Manual has been utilized to prepare farmland assessments. Farm buildings are exempt from taxation to the extent that it is used for farming operations. Farm properties often contain several assessment classes. If the property contains a residence, then the residence along with the first 3.00 acres will be assessed at market value, as if it were a 3.00 acre subdivided parcel. These values are classified as residential on your assessment notice. If there is a commercial or industrial/oilfield operation on the property, all buildings and improvements and the land area used for the operation will be assessed at market value and classified as non-residential. If there is Machinery and Equipment used in these operations, it will be classified as M&E.

• What qualifies for farmland status? The Minister of Municipal Affairs has developed strict guidelines and rules for land classified as “farmland”. By definition, “Farming Operations” means the raising, production and sale of agricultural products and includes

1) Horticulture, aviculture, apiculture and aquaculture.

2) The production of horses, cattle, bison, sheep, swine, goats, fur bearing animals, raised in captivity, domestic cervids within the meaning of the Livestock Industry Diversification Act, and domestic camelids, and

3) The planting, growing and sale of sod.

4) an operation on a parcel of land for which a woodland management plan has been approved by the Woodlot Association of Alberta or a forester registered under the Regulated Forest Management Profession Act for the production of timber primarily marketed as whole logs, seed cones or Christmas trees,

but does not include any operation or activity on land that has been stripped for the purposes of, or in a manner that leaves the land more suitable for, future development;

Should any of the above activities take place on the parcel of land, only then does the land qualify for farm status and assessment as agricultural use value. What does “agricultural use value” mean? It means the value of a parcel of land based exclusively on its use for farming operations.If the land is not used for farming operations as prescribed by definition, the land cannot be assessed as agricultural use value and must, by legislation, be assessed at the market value standard. Please note that when a parcel of land has qualified as farmland, it is assessed using regulated rates (agricultural use value) and this value has no relationship or reflection on the market value of the property.

• Farm Buildings: The definition of a farm building is any improvement other than a residence, to the extent it is used for farming operations. The first order of priority for any building other than a residence to be considered as a “farm building” is to engage in a “farming operation” on your property. Without evidence of farming operations, outbuilding or structures cannot be considered farm buildings. Farm Residence(s): All farm residences in rural municipalities are valued and assessed on the basis of market value. The dominant valuation approach in leading to the market value standard in a rural municipality is the market modified cost approach. The direct sales comparison approach is widely used to complement the cost approach. The income approach is rare and in most cases, is never used on farm property. The value of the farm residence is adjusted based on positive or negative attributes of the property, size and features of the house, services and location. Farm residence(s) can receive exemptions from the market value assessment. In rural municipalities, the Provincial Government allows a farm residence to be exempt on the basis of the amount of farmland assessment in the owner’s unit. The maximum exemption is $61,540 for the first residence of a farm owner’s unit, and $30,770 for each additional residence.

• Machinery and equipment includes a broad range of items used in manufacturing, processing and other industrial facilities.

The assessment for machinery and equipment is prepared using a regulated cost approach. The Alberta Machinery and Equipment Minister’s Guidelines specifies the procedures, formula and rates to be used for assessing machinery and equipment.

Machinery and equipment is assessed by the municipal assessor; however, machinery and equipment that is part of designated industrial property is assessed by the provincial assessor.

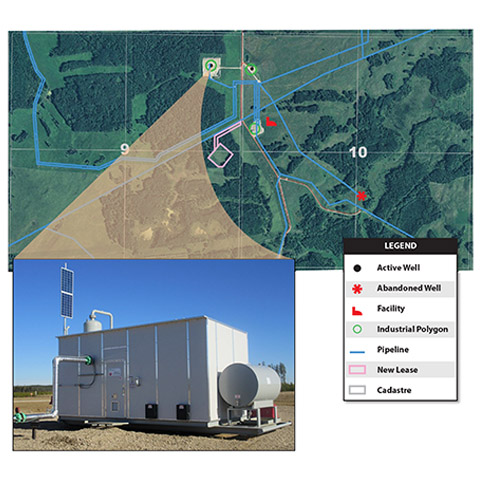

• Designated industrial properties are assessed by the provincial assessor. These property types are defined as:

Properties regulated by the Alberta Energy Regulator, Canadian Energy Regulator, or the Alberta Utilities Commission.

Property designated as a “major plant” by the Alberta Machinery and Equipment Minister’s Guidelines regulation; for example, large refineries, upgraders, pulp and paper mills.

Land and improvements associated with property regulated by the Alberta Energy Regulator, Canadian Energy Regulator, or the Alberta Utilities Commission.

Linear property includes wells, pipelines, railways, telecommunications and electric power systems. Linear property is assessed by the province of Alberta using regulated rates and depreciation schedules.

The provincial assessor’s office works with municipalities, property owners and regulating authorities to prepare the annual provincial designated industrial property assessment notices and rolls, which forms the designated industrial property assessment base in each municipality.